Shares in the French luxury group closed up 3.1 percent on the Paris Stock Exchange on Friday in response to strong fourth-quarter results, as consumers flocked to surefire investments like the brand’s Birkin handbags and Chaîne d’Ancre bracelets.

Shares in the French luxury group closed up 3.1 percent on the Paris Stock Exchange on Friday in response to strong fourth-quarter results, as consumers flocked to surefire investments like the brand’s Birkin handbags and Chaîne d’Ancre bracelets.

Revenues rose 12.3 percent in the three months to Dec. 31, sharply outperforming its sector peers as strong growth in Asia Pacific compensated for continued weakness in Europe and a flat performance in the Americas.

Sales totaled 2.1 billion euros in the fourth quarter, representing an increase of 15.6 percent in comparable terms, sharply exceeding a consensus forecast of 8.7 percent growth.

By comparison, sector leader LVMH Moët Hennessy Louis Vuitton reported a 3 percent decline in organic revenues during the same period, while sales at Kering were down 5 percent in like-for-like terms.

Net profit fell 9 percent in 2020 to 1.38 billion euros, while recurring operating income was down 15 percent to 1.98 billion euros. The recurring operating margin, a key indicator of profitability, improved strongly in the second half of 2020 to reach 31 percent on a full-year basis, beating a consensus forecast of 27.5 percent.

The group plans to pay an exceptional bonus of 1,250 euros to its 16,600 employees in 2021 “for their commitment and contribution to results.”

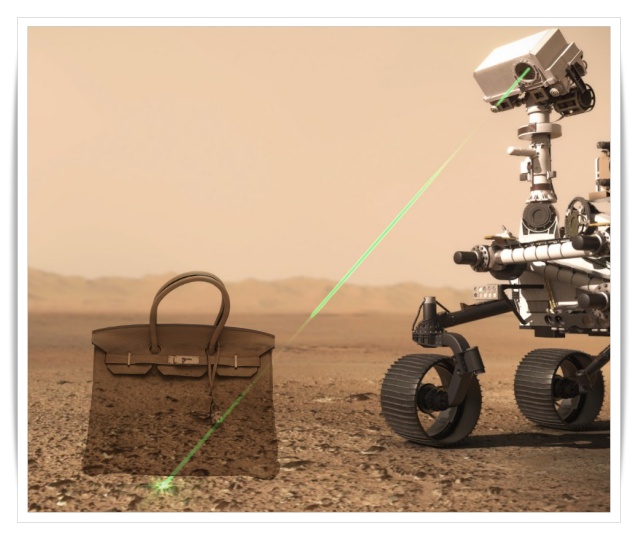

The better-than-expected performance reflects the tendency of consumers to favor safe-haven brands over lesser-known labels as the coronavirus pandemic disrupts spending patterns.